Exploring the intricate relationship between your lifestyle choices and insurance premiums unveils a fascinating insight into how daily decisions can significantly affect your financial protection. From smoking habits to home security measures, each aspect plays a pivotal role in determining the costs of insurance coverage.

Let's delve into the factors that shape this connection and discover how you can make informed choices to optimize your insurance premiums.

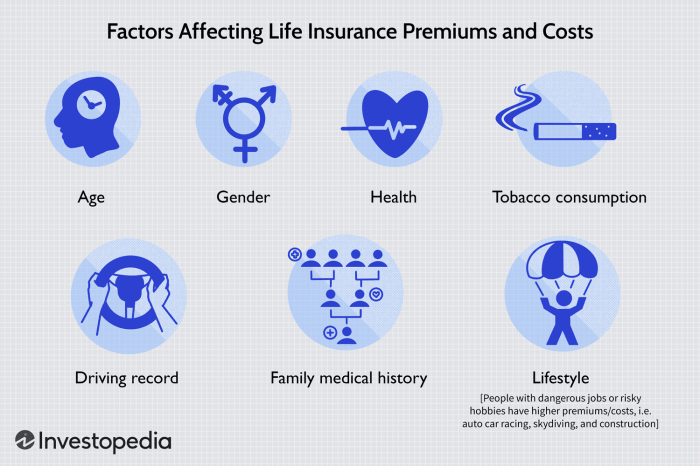

Factors that Impact Insurance Premiums

When it comes to determining insurance premiums, several factors play a crucial role in assessing the level of risk an individual poses to the insurance company. Lifestyle choices, health conditions, and occupation are key elements that can influence the cost of insurance coverage.

Lifestyle Choices

- Smoking: Individuals who smoke are often charged higher premiums due to the increased health risks associated with smoking, such as lung cancer and heart disease.

- Drinking: Excessive alcohol consumption can lead to liver disease, accidents, and other health issues, resulting in higher insurance costs.

- Extreme Sports: Engaging in high-risk activities like skydiving or rock climbing can raise insurance premiums as these activities pose a greater risk of injury.

Health Conditions

- Obesity: Being overweight or obese can lead to various health problems like diabetes and heart disease, prompting insurers to charge higher premiums.

- High Blood Pressure: Individuals with high blood pressure are at a greater risk of heart attacks and strokes, which can impact insurance rates.

Occupation

- Dangerous Jobs: People working in high-risk occupations such as construction or mining may face higher insurance premiums due to the increased likelihood of workplace injuries.

- Sedentary Jobs: On the other hand, individuals with sedentary jobs that involve long periods of sitting may be charged higher premiums as they are more prone to health issues like obesity and back problems.

Healthy Lifestyle Habits

Living a healthy lifestyle can have a positive impact on your insurance premiums. By incorporating healthy habits into your daily routine, you can potentially lower your insurance costs and enjoy better overall well-being.

Regular Exercise and Balanced Diet

- Engaging in regular exercise and maintaining a balanced diet can help reduce the risk of chronic diseases such as heart disease, diabetes, and obesity.

- Insurance companies often offer discounts to individuals who demonstrate healthy habits, including regular physical activity and nutritious eating habits.

- By staying active and eating well, you can lower your risk factors and potentially qualify for lower insurance premiums.

Preventive Health Measures

- Scheduling regular check-ups with your healthcare provider can help detect health issues early on, leading to more effective treatment and lower healthcare costs in the long run.

- Insurance companies may reward individuals who prioritize preventive care by offering lower insurance premiums or additional benefits.

- By taking proactive steps to maintain your health, you not only reduce your medical expenses but also demonstrate to insurers that you are a responsible and low-risk policyholder.

- Installing security systems and fire alarms in your home can lower your insurance premiums as they reduce the risk of theft and fire damage.

- Living in a high-crime area or an area prone to natural disasters can increase your home insurance costs due to the higher likelihood of claims.

- Maintaining your home, such as updating the roof, plumbing, and electrical systems, can also impact your premiums by reducing the risk of damage and claims.

- Your driving habits, such as speeding, distracted driving, and history of accidents or traffic violations, can lead to higher auto insurance rates as they indicate a higher risk of future claims.

- The type of vehicle you drive, including its make, model, age, safety features, and cost of repairs, can affect your insurance premiums. Luxury cars and sports cars often have higher premiums due to their higher repair costs.

- Where you park your car overnight can also impact your rates. Parking in a secure garage or driveway is considered safer than parking on the street, reducing the risk of theft or vandalism.

Home and Auto Insurance

When it comes to home and auto insurance, your lifestyle choices can have a significant impact on the premiums you pay. Factors such as security systems, fire alarms, driving habits, vehicle type, and parking location all play a role in determining the cost of your insurance.

Home Insurance Premiums

Auto Insurance Rates

Financial Stability and Insurance

Maintaining good financial stability can have a significant impact on your insurance premiums. Insurers often consider your credit score and overall financial health when determining your rates. Let's explore how financial stability can influence your insurance costs.

Credit Score and Insurance Premiums

Your credit score plays a crucial role in determining your insurance premiums. Insurers use this score as an indicator of your financial responsibility and risk level. A higher credit score is typically associated with lower insurance premiums, as it suggests that you are more likely to make timely payments and manage your finances well.

Savings and Investments

Lifestyle choices related to savings and investments can also affect your insurance rates. Insurers may view individuals with substantial savings or investment portfolios as more financially stable and responsible. This can lead to lower insurance costs, as it indicates that you may be better equipped to handle unexpected expenses or losses.

Maintaining Good Financial Health

By maintaining good financial health, such as paying bills on time, reducing debt, and saving for the future, you can potentially lower your insurance premiums. Insurers may offer discounts or better rates to individuals who demonstrate financial responsibility and stability.

Additionally, having a solid financial foundation can help you better weather any financial hardships that may arise, reducing the likelihood of insurance claims and ultimately leading to lower insurance costs.

Closing Summary

In conclusion, understanding how your lifestyle impacts insurance premiums empowers you to make conscious decisions that align with your financial goals. By adopting healthy habits, prioritizing safety measures, and nurturing financial stability, you can proactively shape your insurance costs to better suit your needs.

Embrace the opportunity to enhance your insurance coverage by leveraging the insights gained from this discussion.

Question & Answer Hub

How do lifestyle choices like smoking and extreme sports impact insurance premiums?

Lifestyle choices like smoking and engaging in extreme sports can lead to higher insurance premiums due to increased risks associated with these activities.

Can regular exercise and a balanced diet lower insurance costs?

Yes, adopting healthy habits such as regular exercise and a balanced diet can potentially lower insurance premiums by promoting overall well-being.

How does financial stability affect insurance premiums?

Financial stability, including factors like credit score and savings habits, can positively impact insurance premiums by showcasing responsible financial behavior.