Embarking on the journey of “Low-Cost Private Health Plans for Remote Teams and Entrepreneurs,” this introduction sets the stage for an insightful discussion on the unique healthcare needs of modern work settings.

Exploring the nuances of tailored health plans and the advantages they offer to remote teams and entrepreneurs will shed light on the importance of accessible healthcare solutions.

Research on Low-Cost Private Health Plans

Low-cost private health plans are alternative health insurance options that provide coverage at a lower cost compared to traditional health insurance plans. These plans are designed to offer basic medical services and preventive care to individuals, including remote teams and entrepreneurs, who are looking for affordable healthcare solutions.

Benefits of Low-Cost Private Health Plans for Remote Teams and Entrepreneurs

- Cost-Effective: Low-cost private health plans offer affordable premiums, making them a budget-friendly option for remote teams and entrepreneurs who may not have access to employer-sponsored health insurance.

- Flexibility: These plans often provide flexibility in terms of coverage options, allowing individuals to choose the services they need without paying for unnecessary benefits.

- Customization: Low-cost private health plans can be tailored to meet the specific healthcare needs of remote teams and entrepreneurs, providing personalized care at a reasonable cost.

- Accessibility: With online platforms and telemedicine services becoming more prevalent, individuals covered by low-cost private health plans can easily access medical consultations and services from anywhere, making healthcare more convenient.

Differences from Traditional Health Insurance Options

- Cost Structure: Low-cost private health plans often have lower premiums and out-of-pocket costs compared to traditional health insurance, making them a more affordable choice for individuals with limited budgets.

- Coverage Limitations: While traditional health insurance plans may offer comprehensive coverage for a wide range of medical services, low-cost private health plans tend to focus on basic healthcare needs and preventive services.

- Network Restrictions: Some low-cost private health plans may have limited networks of healthcare providers, which can impact the choice of doctors and hospitals available to individuals covered by these plans.

Understanding the Needs of Remote Teams and Entrepreneurs

Remote teams and entrepreneurs have unique health needs due to their flexible work arrangements and the nature of their work. They often face challenges in accessing affordable healthcare, which can impact their well-being and productivity. Tailored health plans are essential for these groups to ensure they receive the necessary care and support.

Specific Health Needs

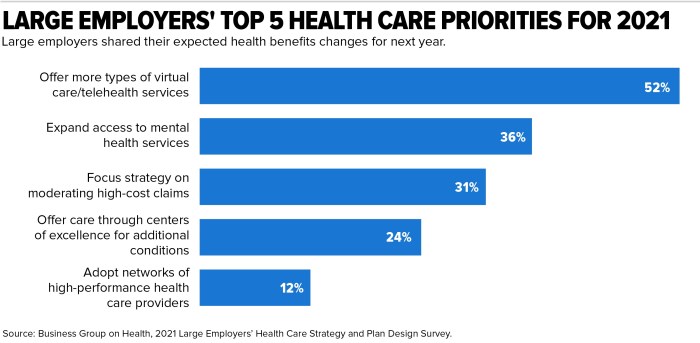

Remote teams and entrepreneurs require health plans that offer flexibility and convenience. They may need coverage for virtual consultations, mental health services, and preventive care. Additionally, access to a wide network of healthcare providers is crucial for those who are constantly on the move or working from different locations.

Challenges in Accessing Affordable Healthcare

One of the main challenges faced by remote workers and entrepreneurs is the lack of employer-sponsored health insurance. Without a traditional workplace setting, they have to navigate the complex individual market, where premiums can be high and coverage options limited.

This often results in many individuals being uninsured or underinsured, putting their health at risk.

Importance of Tailored Health Plans

Tailored health plans are essential for remote teams and entrepreneurs because they cater to their specific needs and circumstances. These plans can offer customized coverage options, such as telemedicine services, flexible payment plans, and wellness programs. By providing access to affordable and comprehensive healthcare, tailored health plans can help remote workers and entrepreneurs stay healthy and productive while pursuing their professional goals.

Features of Ideal Low-Cost Private Health Plans

When it comes to low-cost private health plans for remote teams and entrepreneurs, certain key features can make a significant difference in meeting their specific needs.

Comprehensive Coverage

- Access to a wide network of healthcare providers

- Coverage for preventive care, specialist visits, and emergency services

- Inclusion of mental health services and prescription drug coverage

Cost-Effectiveness

- Affordable premiums and out-of-pocket costs

- Options for high-deductible plans with health savings accounts

- Discounts on wellness programs and telemedicine services

Flexibility and Customization

- Ability to tailor coverage based on the unique needs of remote teams and entrepreneurs

- Options for adding dependents or adjusting coverage levels as needed

- Opportunity to choose between different plan structures and payment schedules

Telehealth Services

- Virtual doctor consultations and remote monitoring capabilities

- Access to healthcare professionals via phone, video, or online chat

- Convenient and timely medical advice without the need for in-person visits

Finding Affordable Options

When it comes to finding affordable health plans for remote teams and entrepreneurs, there are several strategies that can help you secure cost-effective coverage.

Exploring Alternative Options

If traditional health insurance plans are too costly, consider looking into alternative options such as health sharing ministries or telemedicine services. Health sharing ministries operate on the principle of members sharing each other's medical expenses, which can often result in lower monthly costs compared to traditional insurance.

On the other hand, telemedicine services provide remote access to healthcare professionals for consultations and basic medical services, which can be a more affordable option for minor health issues.

Leveraging Group Buying Power

One effective way to find affordable health plans is to leverage the group buying power of your remote team or entrepreneurial network. By pooling together resources and negotiating with insurance providers as a group, you may be able to secure better rates and more favorable terms on health plans.

This collective approach can help reduce costs and make quality healthcare coverage more accessible to all members involved.

Legal and Compliance Considerations

When it comes to offering health plans to remote teams, there are important legal requirements that must be considered. Employers need to ensure that they are compliant with all state and federal laws related to providing healthcare benefits to their employees, even if they are working remotely.

Compliance Standards for Health Plans

- Health plans must comply with the Affordable Care Act (ACA) regulations, regardless of where the employees are located.

- Employers need to ensure that the health plans they offer meet the minimum essential coverage requirements set by the ACA.

- HIPAA regulations must be followed to protect the privacy and security of employees' health information.

Implications of Healthcare Regulations on Low-Cost Private Health Plans

- Healthcare regulations can impact the cost and coverage options available in low-cost private health plans.

- Employers need to carefully review and understand the regulations in place to ensure that their health plans are compliant.

- Changes in healthcare laws and regulations can affect the types of health plans that can be offered to remote teams and entrepreneurs.

Summary

Wrapping up the conversation on affordable private health plans for remote teams and entrepreneurs, this summary encapsulates the key points discussed and emphasizes the significance of prioritizing healthcare in non-traditional work environments.

Answers to Common Questions

What are the main benefits of low-cost private health plans for remote teams and entrepreneurs?

Low-cost private health plans offer tailored coverage, cost-effective solutions, and flexibility that cater to the specific needs of remote workers and entrepreneurs.

How can remote teams and entrepreneurs find affordable health plans?

They can explore options like health sharing ministries, telemedicine services, and leverage group buying power to secure better rates on health plans.

What legal requirements apply to offering health plans to remote teams?

Legal requirements may vary, but it's crucial to ensure compliance with healthcare regulations and standards to provide adequate coverage for remote workers and entrepreneurs.